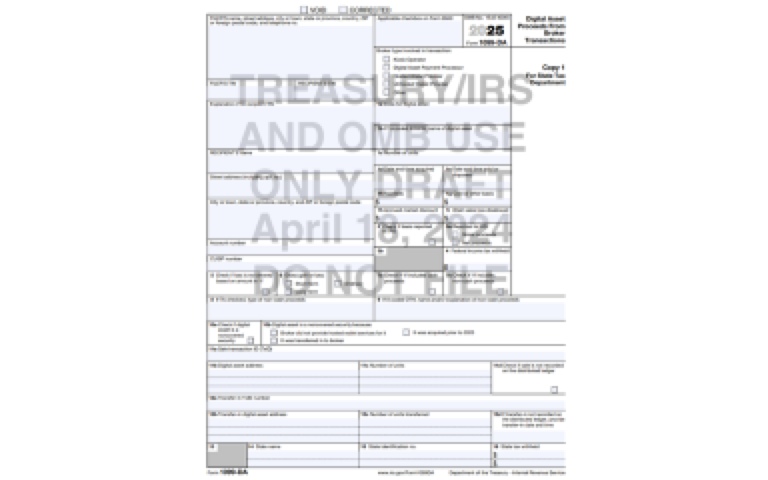

As the IRS prepares to launch the new Form 1099-DA (available in DRAFT form now) for reporting digital asset transactions in 2025, it is essential for investors and tax professionals to grasp the intricacies of this form to ensure accurate tax compliance. While the form aims to streamline the reporting process, it also introduces new challenges and potential pitfalls that require careful attention. This comprehensive overview will dissect the various components of the form, highlighting areas of concern and offering guidance on navigating these complexities.

KEY REPORTING ELEMENTS ON FORM 1099-DA

Transaction Details: The form requires disclosure of basic transaction details such as the type of digital asset, acquisition and sale dates, and the number of units involved. While this helps in tracking the movement and taxation of digital assets, it may prove challenging for taxpayers to gather all the necessary information, particularly for assets held long-term or across multiple wallets and exchanges.

Financial Figures: The form captures financial specifics like gross proceeds, cost basis, and accrued market discount. However, the accuracy of these figures heavily relies on the reporting entity’s ability to track and report the correct information, which may not always be the case.

Basis Reporting: One of the most significant issues with Form 1099-DA is the reporting of cost basis for digital assets. In many cases, the basis of assets transferred from other wallets or exchanges may be unknown to the reporting entity, leaving taxpayers with the burden of determining the correct basis using their own records. This not only complicates the filing process but also increases the risk of errors.

Wash Sales: The form includes a section for reporting disallowed losses from wash sales, despite the fact that the specific wash sale rules for stocks and securities do not currently apply to cryptocurrencies or other digital assets. This discrepancy can lead to confusion and potentially inaccurate reporting, as taxpayers and advisors struggle to interpret and apply these rules in the absence of clear guidance from the IRS. Note that the instructions reference reporting wash sales for “digital assets that are also stock or securities for tax purposes,” which in itself is confusing. It is unclear whether this means the IRS is going to change its long-standing position that digital assets are property, as first established in 2014 (see Notice 2014-21).

Special Considerations for Non-Cash Transactions: The form also accounts for transactions where the proceeds are in forms other than cash, such as services or additional digital assets. This further complicates the valuation process, since reporters will need to determine the USD value of any crypto-for-crypto trades, and increases the likelihood of discrepancies between the reported figures and the taxpayer’s actual gains or losses.

NAVIGATIONAL TIPS FOR TAXPAYERS AND PROFESSIONALS

Record Keeping: Maintain meticulous records of all digital asset transactions, especially when the cost basis is not reported on Form 1099-DA. This is crucial for accurately reporting capital gains or losses and defending your position in case of an audit.

Understand the Definitions: Thoroughly review the definitions and requirements on the form, including what constitutes a digital asset and how different types of transactions should be reported. Pay special attention to any ambiguities or inconsistencies that may require additional clarification from the IRS.

Consult a Professional: Given the complexities and evolving nature of digital asset regulations, it is highly recommended to consult with tax professionals who specialize in cryptocurrency. They can provide invaluable guidance on interpreting the form, identifying potential issues, and developing strategies to minimize tax liabilities.

Stay Informed: Regulations around digital assets are rapidly changing, and it is essential to stay informed about these developments. Closely monitor any updates or clarifications from the IRS regarding Form 1099-DA and its application to ensure ongoing compliance.

CONCLUSION

While Form 1099-DA represents a significant step towards integrating digital asset transactions into the standardized tax reporting framework, it also introduces new complexities and potential pitfalls for taxpayers and professionals. The issues surrounding basis reporting and the treatment of wash sales are particularly concerning, as they can lead to confusion, errors, and increased scrutiny from the IRS.

By maintaining thorough records, seeking professional advice, and staying informed about regulatory changes, taxpayers can navigate these challenges more effectively and minimize their risk exposure. However, it is crucial that the IRS provides clearer guidance and addresses the inconsistencies within Form 1099-DA to ensure a more transparent and equitable reporting process for all involved.